| Volume 5 | Issue 2 |

|

Notable Contracts*

Tyler’s Lakewood, CO, office named a top workplace for the first time.

Tyler announces 2021 Public Sector Excellence Award winners.

Cobb County, GA, selects Tyler for commercial privatization appraisal project.

Tyler’s EnerGov Decision Engine solution helps guide residents through complex government ordinances.

Mendocino County, CA, improves court case management with Tyler’s solution.

Collin County, TX, enables in-person and virtual trials with Tyler’s jury solution. *The above list shows a selection, not a comprehensive list, of Tyler’s recent contract signings to demonstrate the variety of Tyler’s solutions. |

Exploring Tyler’s 2020 Corporate Responsibility Report

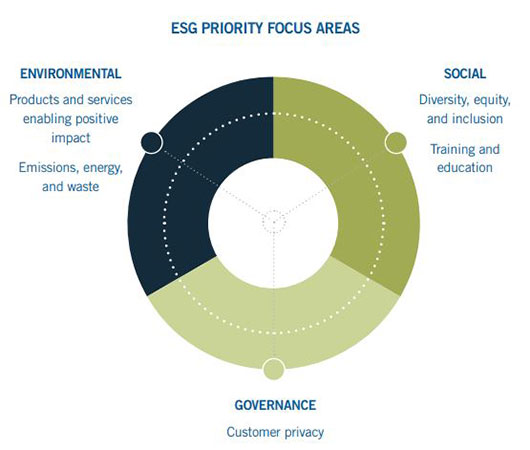

Tyler recently released the company’s second annual corporate responsibility report, bringing greater transparency to Tyler's efforts, accomplishments, and goals around environmental, social, and governance (ESG) topics. While this year’s report covered regular updates about Tyler’s business, employees, and community impact, there was a key focus on how the coronavirus pandemic and racial and social justice issues have impacted Tyler, its clients, and the communities served by its solutions. Tyler is proud to announce some of its notable achievements in the report, which include:

We invite you to learn more about Tyler’s corporate responsibility journey and read the full report on our website here.

Tyler CFO Brian Miller comments on the company’s capital structure, following the closing of NIC Inc., Tyler’s largest acquisition in history. While Tyler has generally carried little to no debt on our balance sheet, that changed recently with our $2.3 billion acquisition of NIC Inc. We financed the acquisition with a combination of cash on hand and approximately $1.75 billion in new debt, all unsecured. In March, we completed a $600 million offering of convertible senior unsecured notes due 2026. Those notes are convertible into Tyler common stock at approximately $493 per share and have an interest rate of 0.25%. Concurrent with closing the acquisition of NIC on April 21, we entered into a new $1.4 billion unsecured credit facility with a group of banks. The facility includes $900 million of Term Loan A debt, with $300 million due in 2024 and $600 million due in 2026. In addition, we increased the size of our revolving credit agreement to $500 million, of which we initially borrowed $250 million. The combination of convertible debt, prepayable term debt, and our revolver gives us a great deal of flexibility to address current and future capital needs, including acquisitions and stock repurchases. Our initial net leverage at the NIC closing is very comfortable at just over three times adjusted EBITDA, and we would expect to use a significant portion our robust cash flow to de-lever. Our total debt currently stands at $1.6 billion, with a blended interest rate of 1.05%, and we have approximately $500 million in cash and investments on our balance sheet. |